Still confused about S/4HANA migration and Phase Zero?

If you're still confused about S/4HANA, you're on the right page.

Here, we explain everything we know about planning your journey to SAP's S/4HANA platform.

Sick of hearing about S/4HANA?

If you’re like most businesses running SAP, you’ve probably heard of S/4HANA. You’ve been on the receiving end of years of SAP marketing and you’ve been approached by every Systems Integrator on the planet.

- But you’re still confused about S/4HANA, right?

- You can’t build a business case for S/4HANA.

- You don’t know what’s different in S/4HANA.

- You’re not sure how to approach your migration from ECC.

If that’s the case, you’ve landed on the right page.

Resulting don’t resell SAP software and we don’t run large S/4HANA based business transformation programmes.

So, this is the most down-to-earth, honest and practical S/4HANA advice you’ll find.

It’s based on real experience gained working with large SAP customers on their ECC to S/4HANA projects.

“How do I build a business case for S/4HANA?”

The fact that SAP decided to re-engineer their database platform to win your wallet share from Oracle (or whoever else had it) doesn’t mean you have to dance to their tune.

Sure, SAP has asked customers to walk a plank by putting an end-of-life support date on ECC - but that plank has lengthened once already. And, there are many options available beyond blindly moving to S/4HANA.

Plus, by atomising their central ERP solution into a meaty core with cloud-based add-ons, SAP have made a rather comfortable bed for you to sleep in.

Ariba, Success Factors, Hybris and the like all require challenging cloud-integration which is in no-way native or straightforward.

TIME FOR BEST-OF-BREED...?

This means that alternatives like Coupa, Workday and Salesforce are viable options with similar integration challenges.

And the lines may blur further, with some companies looking at downsizing their core ERP component with rapidly improving alternatives like MS Dynamics, Netsuite, Infor and IFS.

Thousands of disappointed businesses have struggled with the inflexibility of SAP for decades.

Hoshin What?

The Japanese have a term - Hoshin Kanri - which loosely translates as "Vision Compass".

It’s used by progressive corporations to ensure that strategy and strategic thrusts make their way into operational activities.

WE DON'T EVEN HAVE A BUSINESS STRATEGY...

You do have a strategy. Most large businesses do.

It may be hidden away on some executive slide deck or document that you haven’t seen yet. It may be on your corporate website for shareholders to browse, and you’ve been left in the dark.

Or, it may be emblazoned on creative posters, screensavers and mouse mats in your offices.

Whichever it is, that’s what you should start with.

TIME TO BE SELFISH...?

Instead of looking to build a business case for S/4HANA, focus on building a business case for your own business strategy.

What’s your strategy and what are your key strategic thrusts.

You should take time to elicit your strategic thrusts from your business strategy. Then, use them as the key themes of your enterprise software roadmap.

Identify how your ERP can address your strategic thrusts and define a portfolio of work that business leaders will lean-in to.

IT'S YOUR SAP DRUM TO BEAT

If S/4HANA is part of this roadmap, cool.

If most of that stuff can be delivered in ECC, even better.

The key lesson here is to march to your own drumbeat.

Not to the drumbeat of a salesperson with a big quota

at a software vendor or consulting firm.

Get under the skin of your strategic thrusts

BUILD A NEW NARRATIVE THAT RECONNECTS IT BACK TO THE BUSINESS

Most IT / Business relationships are strained - partly because IT sees itself as separate from the business and the business sees itself as separate from IT.

But let’s be clear - IT is a department of the business. It is part of the business, not separate from it. So to truly anchor an ERP roadmap and business case you need to short circuit this chasm and rebuild rapport.

If you think you already have decent rapport, great. But most people don’t - they've just convinced themselves that they have.

So try this.

Record interviews and transcribe them.

Use an independent 3rd party (a shameless plug for what we do) to interview your key execs and discuss how future ERP solutions must support the business strategy.

WHAT ARE THE BENEFITS OF USING A 3RD PARTY..?

-

The traditional business vs IT emotion is removed and Execs speak more freely.

- A different tone can be set with Execs in terms of strategic business alignment - which is crucial at the outset of business change.

- This step allows you to build a narrative for your ERP roadmap - which then provides the scaffolding for your business case.

- And, it enables you to play back the roadmap in language that resonates with your key stakeholders.

Yes. But what about SAP tools like BSR?

SAP TELL ME THAT IT'LL CREATE MY BUSINESS CASE FOR ME

Most SAP customers we speak to have opted for the Business Scenario Recommendation report (v2.0 even) that SAP provides.

And why not? It’s free, right?

Sure, it will tell you which parts of SAP you use today. It will also do some rudimentary benchmarking of your KPIs to convince you of the business benefits you could realise by moving to S/4HANA.

But they’re generally generalisations. They don’t take into account the nuances of your business and don’t really provide an apples vs. apples comparison.

We’ve been asked a number of times to review BSR outputs by SAP customers and we generally concur with the customer's view that the report lacks credibility and authority.

WHERE SAP'S BSR TOOL RUNS OUT OF RUNWAY

What’s worse, is that the BSR fails on two important points.

- It fails to tell you which areas of ECC are being removed as part of the S/4HANA migration. Small things like Payroll for example.

- It over-fascinates what you use in ECC today at the expense of where else you might use given the chance to look under-the-hood

Some of your business case will be in the white-space areas of SAP that you don’t currently use.

So, how do I get into the details of what S/4HANA will do for me...?

Put simply, you need to become much more self-centred.

You’re going to need to be clear on the scope that your ERP solution will cover.

In the old days, early SAP projects used a Business Process Master List (BPML) to drive scope.

Organisations who had a BPML found the concept useful - as it provided a basis for design, testing and training.

But most organisations failed to maintain the BPML after go-live - it fell between the cracks of IT and the business.

This isn’t the same as mapping your business processes. We’re not suggesting a 1990’s style BPR exercise.

This starts with a simple spreadsheet that lists out the processes that your business runs.

We evolve this into what we call a Business Process Framework which defines the scope of your business processes along with meta-data that informs roadmapping and portfolio planning.

This involves adding in Process Variability, Operational Frequency. Transaction Volumes, Complexity, Isolation (vs. Integration), User Volumes, Change Impact, Workarounds, Usability & Defects for each process.

What are the benefits of a Business Process Framework...?

AND HOW WILL THEY HELP ME BEYOND MY S/4 MIGRATION?

In addition, the Business Process Framework analysis can also enable...

-

Portfolio Shape Analysis which maps Competitive Advantage of business processes to Customization if your ERP solutions to drive Architectural decision making.

-

Mapping business processes to potential RPA (Robotic Process Automation) opportunities.

-

Identifying each processes suitability for Shared Service Centre delivery.

-

Mapping processes to the Toyota 7 Wastes framework to identify cost reduction opportunities.

AND DON'T FORGET TEST AUTOMATION FOR S/4HANA.

If you spend too much time testing (or not enough). If your SAP releases have historically taken months to push live due to test defects or waiting on UAT. Or, if you constantly find SAP issues in production after making changes. Then you ought to look at Test Automation for SAP.

Your move to S/4HANA is the ideal time to clear the decks and move into the 21st century. A Business Process Catalogue provides the perfect basis for Test Automation because, once your processes are correctly categorised, you have your automation hit list. Focus on the processes that matter most first (remember Pareto?) - start small but focus on value.

Start with a get-fit programme to automate your ECC processes with a plan to accelerate your S/4HANA move - and validate business process results through automation along the way

Do we need to start from scratch to build a process catalogue...?

IT SOUNDS USEFUL, BUT ALSO LIKE IT COULD BE A LOT OF WORK.

If you already have a standard list of business processes, this can form the basis of your Process Framework.

However, we advise you standardise on APQC.

Not only is it the most comprehensive open-sourced business process framework available, but there are some other key benefits of using APQC as a foundation.

- APQC have 20 process models including a core model and 19 industry variants.

- APQC invests time and effort updating their process model as new business models evolve - and are diligent with their version control.

- APQC publishes over 2,500 KPIs linked to their process model - providing a ready-made framework for your S/4HANA business case and analytics design.

- APQC provides reliable benchmarking data for a large proportion of processes and KPIs indexed back to their catalogue.

DO APQC & SAP PLAY NICELY..?

Although not common knowledge, in 2020, SAP are standardizing their Reference Architecture on the APQC process framework - meaning that all future product releases will map seamlessly into your Process Framework.

So, by building a detailed Process Framework linked back to APQC you bake in best-practices and future SAP solution referencability whilst also accelerating the time it takes to reconstitute your business process model.

Curating your S/4HANA Blueprint

WORKING OUT WHAT'S DIFFERENT AND WHAT MATTERS TO YOU.

Given that statistic (validated at a number of live Resulting research events with ECC customers) - is it any wonder that you find it so hard to build a business case for S/4HANA?

First, you need to understand what’s new, what’s changed and what’s been completely removed from S/4HANA.

You need to do this alongside your Business Process Catalogue - so that you can identify what’s new in the areas that matter most.

Which existing challenges (workarounds, usability issues, complex areas listed in your Business Process Framework) will S/4 functionality resolve for you?

Crucially, what functionality is being taken away? You’ll need to find alternative solutions for these things before you move to S/4HANA.

The big gotchas are Payroll and SRM. But the devil is in the details - with hundreds of minor ECC transactions and features now obsolete.

WHAT'S DIFFERENT IN S/4HANA...?

What functionality is being changed significantly? You’ll need to plan for training, comms and maybe change management for these things.

How have data objects changed? And what does this mean for reports, interfaces, forms and downstream analytics?

You and your team need to immerse yourselves in these details as this provides the jigsaw pieces.

Most importantly, by spending time reviewing what’s new and different in this way, you’ll stumble on functionality that ticks off big strategic thrusts or solves big business pain points.

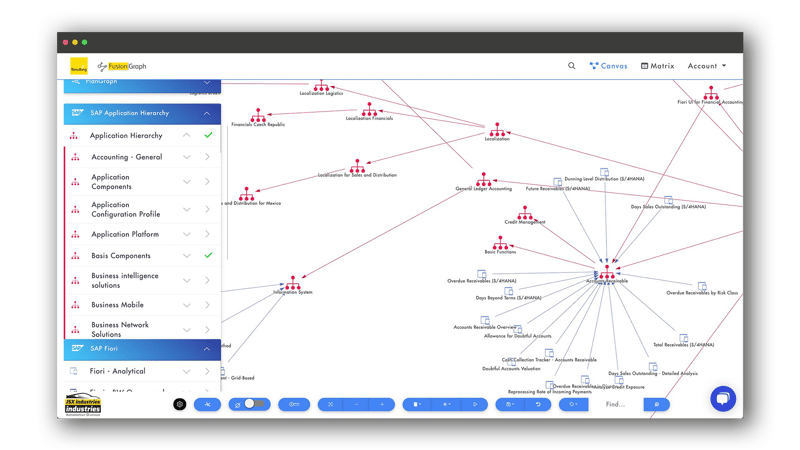

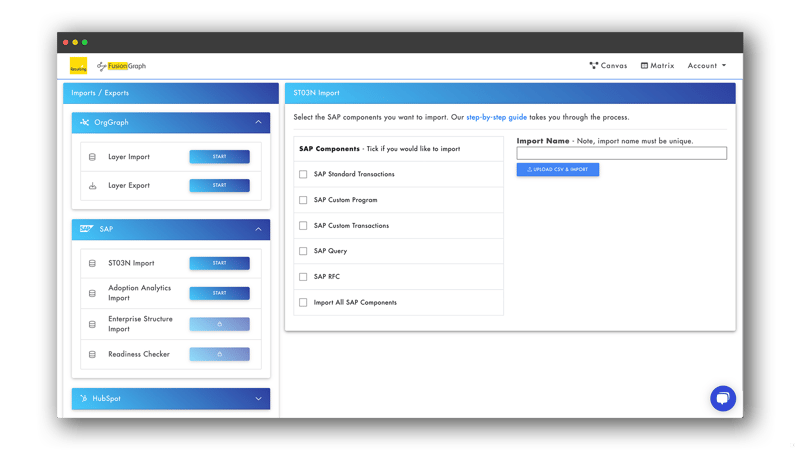

Doing this with FusionGraph

Based on our experience of running this tried and test process with a number of SAP customers, we recognised the need to simplify the process.

R&D and customer pilots led to the creation of FusionGraph - the only cloud based platform that visualises what’s new and different in S/4HANA.

FusionGraph enables SAP customers to search and visualize S/4HANA features by business process area so that they can flag and curate interesting items.

We ingest each version of S/4 HANA and enable version specific filtering - so that you can continue to use FusionGraph as you adopt future upgrades.

VISUALIZE WHAT'S DIFFERENT IN S/4 HANA

FusionGraph can also import ECC usage logs (ST03N) and visualise what’s new, different and deleted in S/4HANA based on the transactions you use today.

Finally, FusionGraph links the whole SAP Application Hierarchy to APQC processes and KPIs - meaning that you can visualise your Business Process Catalogue too - alongside S/4HANA functionality.

What’s the key to a good S/4HANA business case?

THE CLUE'S IN THE TITLE....

A reminder - the K in KPI stands for Key.

Traditionally, IT business cases and benefits are not tracked and measured. Similarly, business intelligence and analytics platforms fail to deliver the required output.

Through the AQPC aligned Process Framework analysis and FusionGraph curation, we are able to tap into APQC’s 2,500 KPIs to identify the levers that matter most to your business.

You should take measurements before and after. If you’re evaluating process mining using Celonis or Spotlight from SAP, this is a great team to get serious about KPIs and benefits tracking.

If you do invest in taking measurements, why not also benchmark your existing performance against your peers using APQC benchmarks now. This will serve as a business case baseline.

The I in KPIs stands for Indicators. These are the things that indicate performance changes. You’ll want to feed these into your solution design for analytics and your future data model for ERP.

Creating your S/4 HANA Roadmap

Armed with your strategic narrative, a structured business processes catalogue, and your detailed blueprint items, you’re in a position to build a roadmap.

This includes the options for S/4HANA migrating to S/4HANA in terms of sequence and dependencies.

The roadmap is also where you call-out areas that are not delivered as part of S/4HANA and an assessment of alternative or complementary solutions and approaches (including non-SAP Best of Breed options).

The Roadmap considers hosting, integration and improvement activities (e.g. archiving, data quality) that can be done in parallel.

It enables you to build a rough order of magnitude cost model - including an impact assessment of licencing, consulting services and technology costs (e.g. sizing and hosting).

Finally, it provides a timeline that you can run by your stakeholders to agree timings of benefit delivery and ensure that change management does not overload critical business functions based on other priorities.

Pulling it all together

How you present all of this to your Execs and business leaders is critical.

- They don’t want tech jargon.

- They don’t care about version numbers or patch levels.

- They don’t care if S/4HANA runs on AWS, Azure, Alibaba or AOL.

Don’t produce a dry 100 page word document with an 11pt font. Don’t machine gun them with bullet points across 50 PowerPoint slides. Don’t circulate a visual slide deck that needs a voice over.

You’ll lose them every single time.

Instead, invest in a very early stage piece of change management content.

Use everything you’ve gleaned above. Use their language (and soundbites). Link everything back to strategy. Use the narrative.

Make it real for them.

Create an ERP Playbook.

A final word on that S/4HANA Business Case...

Now you have clarity on what you need to do - both at a big picture level and the detail.

You know the sequence, the systems and the functionality you’ll get.

- You have a timeline and costs.

- You have your business process scope.

- You have KPIs and an idea of benefits.

All you need now is Excel and you can build the business case you wanted.

But be honest with yourself.

You don’t really want a business case do you?

No.

You really want to play a massive part in delivering technology that underpins your business strategy.

Don't migrate to S/4HANA until you've read this research

If you're thinking about your move to S/4HANA here's where you start.

In this report you'll discover what your peers are doing when it comes to S/4HANA migration, how they're building their business case, and if they're integrating the newest features of S/4HANA.